Our Discretionary Portfolio Management

Azimut’s Flexible Approach

Azimut’s wealth management solutions aim to grow and preserve substantial assets over time.

Our wealth management service is characterized by a flexible and personalized investment approach.

We begin by analyzing the client’s needs in terms of capital preservation, the use of the most efficient investment vehicles and risk tolerance.

The selection of individual investments is based on a comparative analysis of the risks and opportunities of each position, constructing portfolios in accordance with the constraints of each personalized mandate.

Wealth Management

Azimut provides an External Asset Management (EAM) platform for Private Bankers which allows them to provide to their clients:

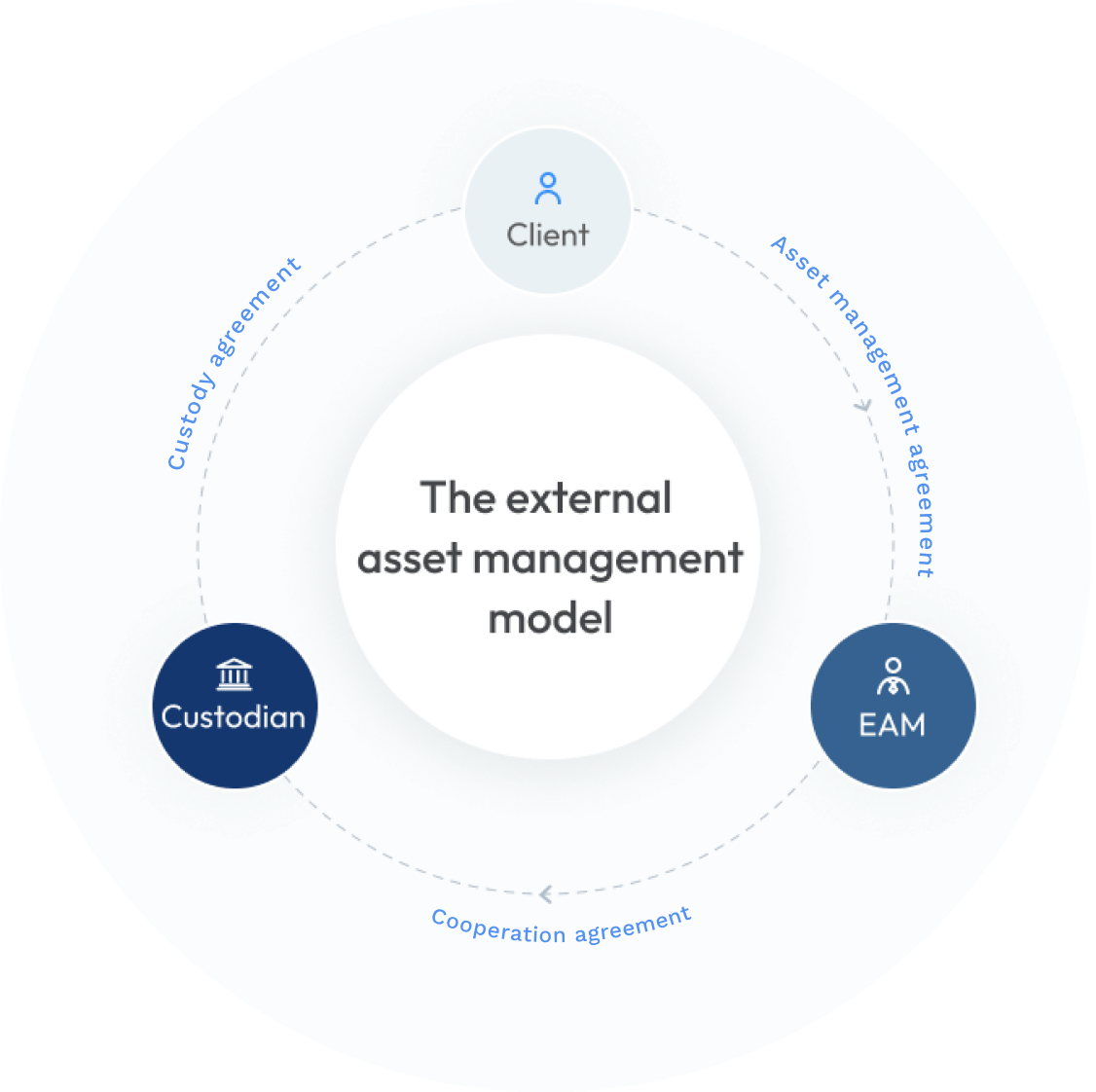

Business model (EAM)

The client deposits their wealth with a Swiss or foreign bank of their choice. Azimut Switzerland manages the assets on behalf of the client through a limited power of attorney granted by the client.